texas estate tax limits

And to find the amount due the fair market values of all the decedents assets as of death are added up. The current cap for the annual increase is 8.

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Any estate that exceeds these thresholds is subject to the federal estate-tax of 40.

. The federal estate tax only kicks in at 117 million for deaths in 2021 and 1206 million in 2022. Technically a Texas homesteads assessed value is limited to the lesser of either its market value or the sum of the market value of any new improvements and 110 of the appraised value of the preceding year. If a taxing unit raises more than 8 of the property tax revenue of the previous year voters can file a petition.

Community colleges hospital districts and small taxing units with rates of 25 cents per 100 of taxable value or less will need voter. Regardless of the size of your estate you wont owe estate taxes to the state of Texas. Texas Proposition 1 the Property Tax Limit Reduction for Elderly and Disabled Residents Amendment is on the ballot in Texas as a legislatively referred constitutional amendment on May 7 2022.

3 estate taxes and penalties relating to estate taxes. The market value of the property. 1 day agoThe proposed changes could mean a homeowner with a house that was assessed at 200000 in 2021 could end up paying 10 less on their city property tax bill this year even if the taxable value of.

The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The 10 increase is cumulative. If that reappraisal occurred two years ago your new assessed value can exceed last years by 20.

A yes vote supports amending the state constitution to authorize the state legislature to reduce the property tax limit for school maintenance and operations. The homeowners property tax is based on the county appraisal districts appraised value of the home. Under current federal tax law estates with a value of less.

A Except as provided by Section 310004 a and unless the will provides otherwise all expenses incurred in connection with the settlement of a decedents estate shall be charged against the principal of the estate including. The limitation applies only to a residential homestead. The Dallas-Fort Worth metroplex set its own record in March with a median home price of 335000 up 19 percent.

The estate tax is a tax on an individuals right to transfer property upon your death. This means that the Texas Constitution also limits the Texas Legislature from imposing an inheritance or estate tax on real and personal property. The appraised value of the property for last year.

SB 2 Texas Property Tax Reform and Transparency Act of 2019 by Bettencourt R-Houston is an omnibus bill that makes significant changes to local government tax rate-setting truth-in-taxation rollback tax rates elections to approve tax increases appraisal review board procedures and local government notices and websites concerning. In 2018 the thresholds for a single persons Texas estate tax were estimated to be 58 million and 112 million for a married couple. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

You must have filed for the homestead exemption. You might owe money to the federal government though. Once again Texas has no inheritance tax.

So inheritors should not expect to pay any property tax on real estate acquired from a deceased parent as it is real property. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. Currently California only allows up to a 2 increase based on the value of the property.

Also good news over 90 percent of all Texas estates are exempt from federal estate taxes. Texas legislators have tried numerous ways to limit property tax growth. Because both tax rates and property values fluctuate year to year property tax bills can be a scary unknown.

Fortunately in Texas if you have a homestead exemption in place your property tax appraisal increase limit is capped at 10 year over year which helps to protect you from large annual increases in property tax. A Three Thousand Dollars 3000 of the assessed taxable value of all residence homesteads of married or unmarried adults male or female including those living alone shall be. That run up in real estate prices was especially beneficial for homeowners who were in the market to sell but potentially more costly.

There is a 40 percent federal tax however on estates over 534 million in value. Lawmakers have raised the states homestead exemption the portion of a homeowners home value exempt from taxation. The Houston metro saw its median price jump to 335000 155 percent.

And in 2021. The 10 limitation is an annual limit to the assessed or taxable value and it dates from the latest reappraisal. 10 percent of the appraised value of the property for last year.

From Fisher Investments 40 years managing money and helping thousands of families. 1 Any funds after that will be taxed as they pass. Meanwhile in Texas property appraisals have reached 10.

In Texas the federal estate tax limits apply. RESIDENCE HOMESTEAD TAX EXEMPTIONS AND LIMITATIONS. Tax Code Section 2323 a sets a limit on the amount of annual increase to the appraised value of a residence homestead to not exceed the lesser of.

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Ap 201 Texas Application For Texas Sales And Use Tax Permit

Irs Issues New Rules For 1031 Exchanges Texas Tax Talk

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

Talking Taxes Estate Tax Texas Agriculture Law

Pin By Adrienne Bryant On Move Estate Tax Understanding Moving

Sales And Use Tax Rates Houston Org

State Corporate Income Tax Rates And Brackets Tax Foundation

Texas Property Tax Exemptions To Know Get Info About Payment Help Property Tax Exemptions In Texas Tax Ease

Texas Sales Tax Small Business Guide Truic

Californians Moving To Texas Texas Taxes Vs California

Texas Inheritance And Estate Taxes Ibekwe Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas State Taxes Forbes Advisor

Texas Retirement Tax Friendliness Smartasset

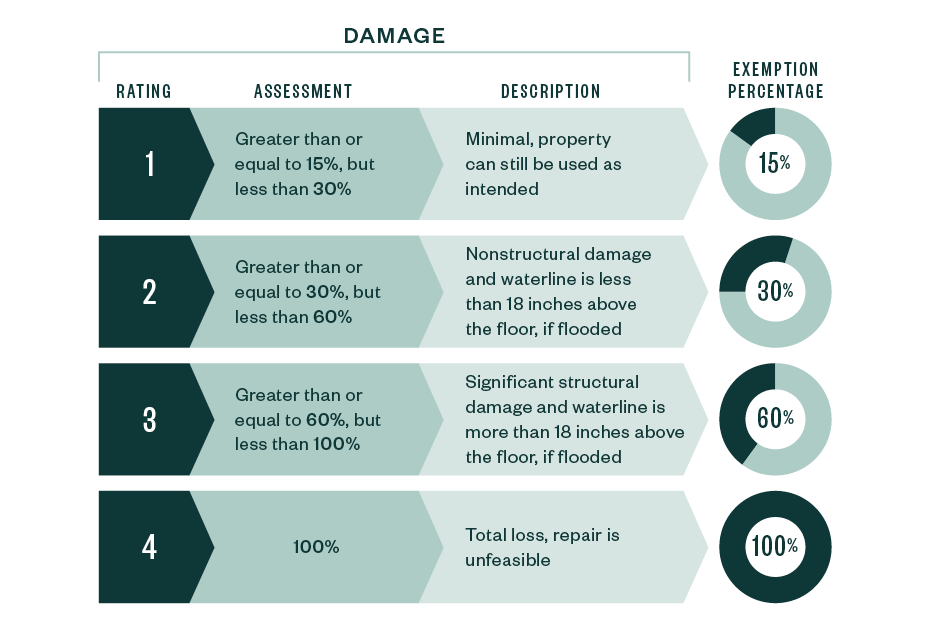

Hurricane Nicholas Hits Texas Property Damage Tax Relief

Over 65 Property Tax Exemption In Texas

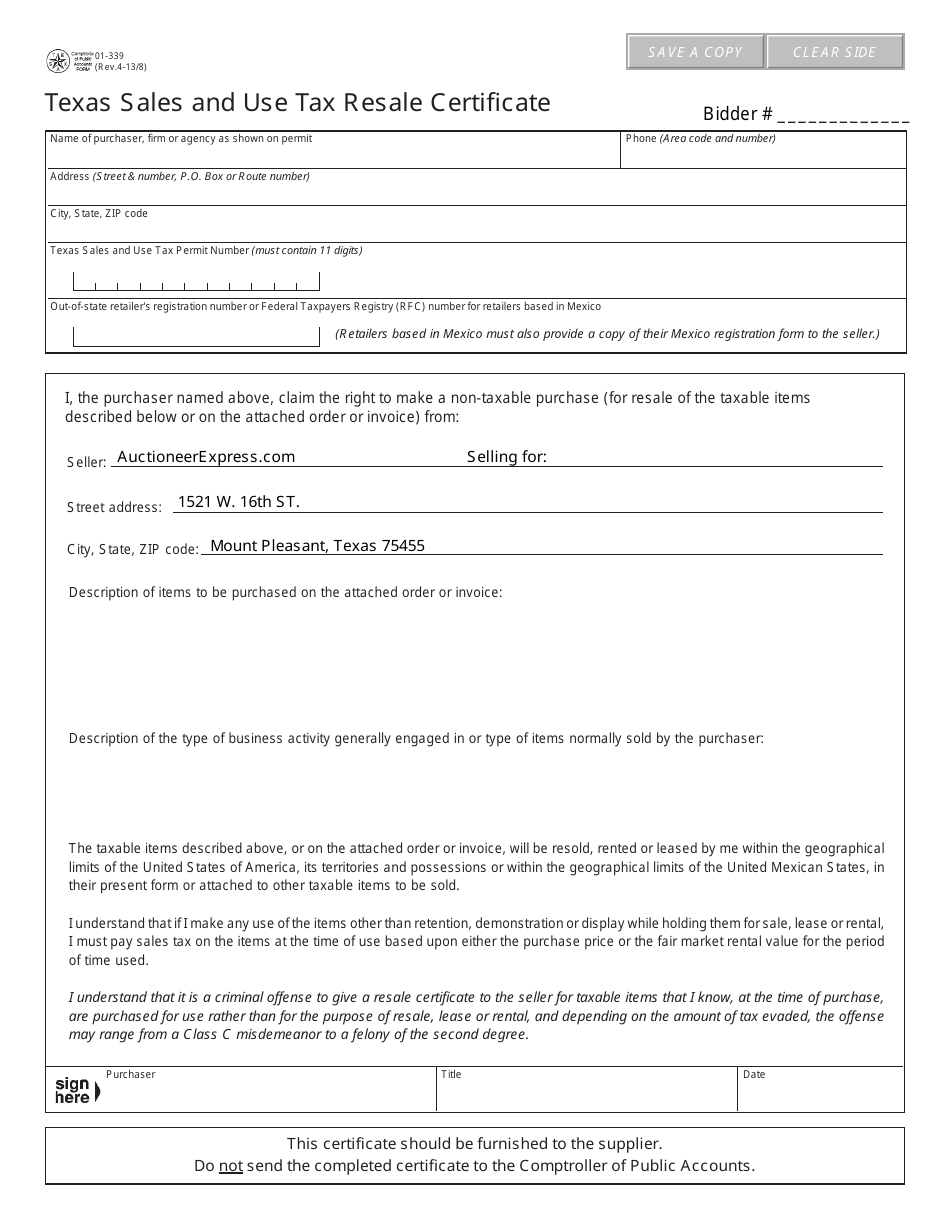

Form 01 339 Download Fillable Pdf Or Fill Online Texas Sales And Use Tax Resale Certificate Texas Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die