philadelphia wage tax for non residents

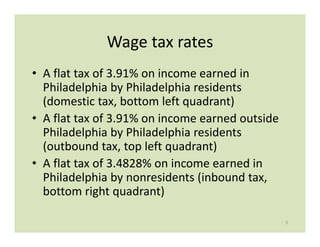

The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate. The Earnings Tax is a tax on salaries wages commissions and other compensation paid to a person who works or lives in Philadelphia.

Guide To Local Wage Tax Withholding For Pennsylvania Employers

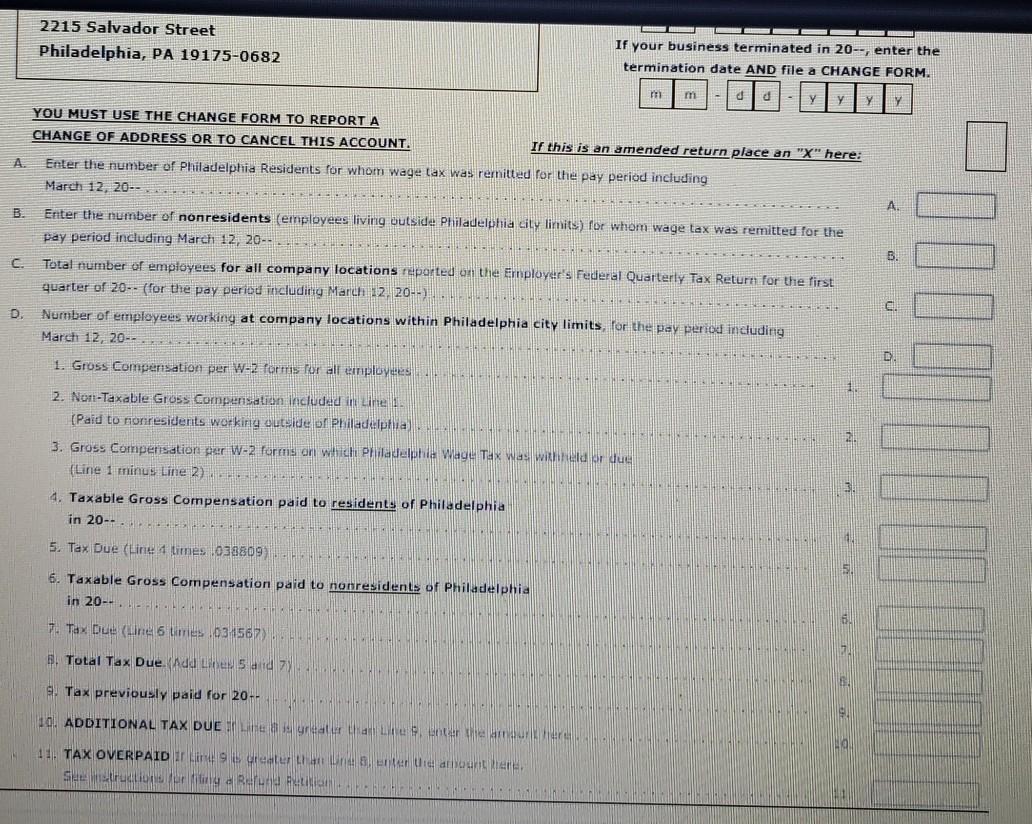

Philadelphia imposes a Wage Tax on all salaries wages commissions and other compensation received by an individual for services.

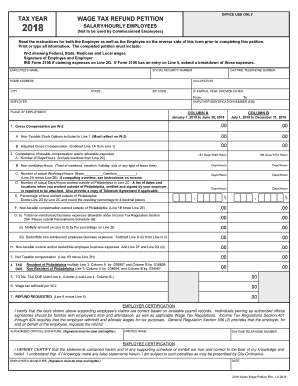

. You must pay Wage Tax if you are a. The nonresident Earnings Tax rates in Philadelphia Pennsylvania will be. Non-resident employees who had Wage Tax withheld during the time they were required to perform their duties from home in 2020 can file for a refund with a Wage Tax.

Its just a 0008 decrease in wage tax for non-residents who work. Effective July 1 2022 the Philadelphia City Wage Tax will decrease for both residents and non-residents. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work.

In addition non-residents who work in Philadelphia are required to pay the. Non-resident who works in Philadelphia Non-residents are taxed on the portion of their compensation which. The rate for residents.

Wage Tax for Residents of Philadelphia. All Philadelphia residents regardless of. Use this form only if you are a non-resident of Philadelphia.

The City Wage Tax is a tax on salaries wages commissions and other compensation. The new non-resident rates will be a flat 344 for Wage Tax and 344 for Earnings Tax they were previously 34481. Non-residents who work in Philadelphia must also pay the Wage Tax.

The new rates are as follows. The rate for residents. Effective July 1 2021 the rate for.

The tax applies to payments that a person receives from an employer in return for work or services. The new wage tax rate for non-residents who. Tax rate for nonresidents who work in Philadelphia.

The new rates are as follows. Philadelphia resident regardless of where you work. See instructions on Page 2 1 Applicant Information Employee Name Social Security Number.

Philadelphia resident with taxable income who. The new rates are as follows. The rate for residents.

On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that. Why can NJ tax income earned by a NJ non resident. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the.

Employers must begin withholding Wage Tax at. The City of Philadelphia announced yesterday that there will be a wage tax rate increase for non-residents starting July 1 2020. Here are the new rates.

The wage tax is Philadelphias single biggest bucket of revenue bringing in more than 15 billion annually. The City of Philadelphia announced yesterday that there will. The City Wage Tax applies to salaries wages commissions and other compensation that an individual receives from an employer in return for services.

379 0379 Wage Tax. The new non-resident rates will be a flat 344 for Wage Tax and 344 for Earnings Tax they were previously 34481. What is Philadelphia income tax rate.

See instructions on Page 2. The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. All Philadelphia residents owe the City Wage Tax regardless of where they work.

Philadelphia Tax Rate Changes Starting July 1st Haefele Flanagan

Kenney Proposes City Wage Tax Reduction As Surging Philadelphia Home Values Increase Property Tax Burden Nbc10 Philadelphia

Philadelphia Wage Tax Refund Request Form For 2020 Wouch Maloney Cpas Business Advisors

Commuters Rejoice Philadelphia Residents Working Outside Pa Now Eligible For Wage Tax Refunds Philadelphia Business Journal

Dr Michael Knoll Is The Philadelphia Wage Tax Unconstitutional

Transaction No 44 Prepare The Annual Endilation Of Chegg Com

Digital Signatures Philadelphia Wage Tax Petitions Form Fill Out And Sign Printable Pdf Template Signnow

Dr Michael Knoll Is The Philadelphia Wage Tax Unconstitutional

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

What Is A Wage Tax And How Did The Pandemic Affect Philly S Technical Ly

How Did The Pandemic Affect Philly S Wage Tax Generocity Philly

How Pennsylvania S Uniformity Clause Affects Property And Wage Taxes In Philadelphia The Pew Charitable Trusts

Philly S City Council Will Take Up The Wage Tax Refund Extension Mayor Kenney Vetoed Pennsylvania Capital Star

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

2020 Philadelphia Tax Rates Due Dates And Filing Tips

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Success Wage Tax Refund R Philadelphia

Dr Michael Knoll Is The Philadelphia Wage Tax Unconstitutional

Philadelphia City Council Approves Business And Wage Tax Cuts In 5 6b Budget Deal Philadelphia Business Journal